I'VE BEEN ALTERNATING, lately, between a series on Reality, Spirituality, and Politics, and various other kinds of posts—and had intended to return to the series today.

But I ran into some interesting information which is actually closely related to that series, and happens also to be relevant to current developments in Washington D.C.

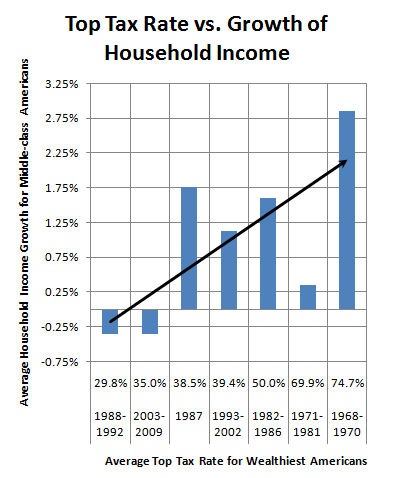

I'll begin with a graph, to give you a peek at where this is leading:

The graph shows the relationship between various top tax rates on the super-wealthy over the last few decades (along the bottom) and the rate at which the third quintile for household incomes (around $61,000 in 2009) grew, adjusted for inflation.

All the information in the graph is readily available:

- I obtained the data on household incomes from government census data, and the top tax rates for various years from the Tax Policy Center, and calculated the yearly rate of income growth from the census data.

- I grouped the data by periods during which rates stayed the same or very close to each other, and graphed the average rates for those periods against the average yearly growth in household incomes for the same period.

You'll notice that, in general, the higher the top marginal tax rate, the faster household incomes grew—and that when the rate dropped below 38% household incomes actually declined.

What has this graph got to do with reality, spirituality, and politics?

As I write this, Republicans are campaigning to give the richest people in the country a tax cut.

They're doing this on principle—as though it were a moral (that is, spiritual) issue.

They are arguing, among other things, that we can't afford to let taxes for the super wealthy to go up during a recession—that would be irresponsible, and cruel to working people.

That idea is based, not in reality, but in ideology.

A quick look at the graph above shows that reality doesn't share their ideology.

And that puts them in the position of arguing, on a moral basis, for a policy which may well harm most Americans.

The only people who will benefit from from a tax cut for the wealthy are the wealthy .

But even the relatively wealthy may not benefit from that tax cut:

The chart above shows the same data for households at the 95th percentile (around $180,000 in 2009).

Only 5% of American households are wealthier.

Even at the 95th percentile, household incomes have grown faster when the top tax rate was higher.

But there is a serious difference between the two charts.

At the lowest tax rates the 95th percentile is still gaining ground, while the middle class is losing ground.

Which means in essence that, when there were lower tax rates at the top, income growth was actually being transferred from the middle class to 95th percentile.

It's even a bit worse than that for the poorest households.

This is what Republicans are arguing for, while claiming the high moral ground.

Their moral outrage over the top marginal rates is in favor of a policy which appears to have undermined the middle class, and the poor, in favor of the wealthiest—while actually damaging all three.

It certainly hasn't done what they claim it will do.

There are, on the surface of the question, many good reasons for high tax rates at the top:

-

To counteract the ability of the wealthy to accumulate more than their fair share of wealth that is actually produced by the hard work of the rest of the country,

-

To keep the gap between the wealthy and the rest of the country from growing to the point that we end up with a tiny elite ruling over a nation of slaves,

-

To make it possible for Americans to afford programs that create a healthy, well-educated, and safe life for their children,

-

To preserve democracy by making sure that some people aren't so much richer than everyone else that they can simply buy control of the government.

Republicans don't want to address these issues, because they know they are on the wrong side of every single one, so they make up a story that lowering taxes on the super-wealthy will help us all.

But it isn't true—it's a fairy tale, suited to people who believe in Santa or the Easter Bunny.

And, like those stories, it's a false spirituality—there is no Santa, and taking money from the middle class to make the wealthy wealthier will not magically help the rest of us.

At least, that's what I think today.

Next: A look at corporate tax rates...