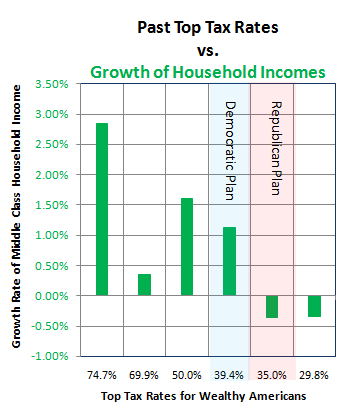

THIS POST IS MOSTLY about the correlation of corporate tax rates with growth in household incomes, but I'll begin with a revision of the chart on top income tax rates.

This is meant to address all the constructive criticism which has come my way in the last two days—as some people found the previous chart confusing.

So here's a new version, with less information on the whole, and one minor edit:

The data is the same as the previous chart, except that I removed a single bar which showed income growth with taxes at 38.5%, because that rate only existed for a single year, and I thought it was misleading to include it, as the effect of a tax rate probably takes time to kick in. (The previous years had been at 50%.)

Fair disclosure: I did not remove the 74.7% data, even though that is an average of only two years, because rates had been similar for the previous decade even though I only had the household income figures for 1968-1970.

I think it's easier to notice, on the new chart, that the difference in tax rate between the two proposals on the table is relatively small, while the difference for the middle class may be between gaining or losing ground.

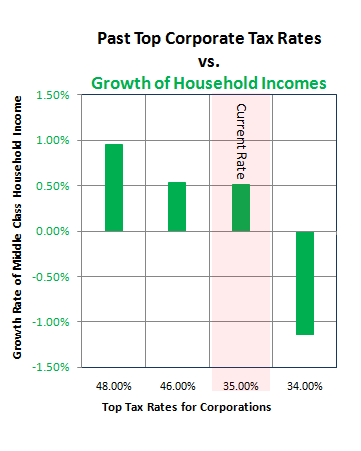

But on to corporate tax rates:

The methods I used to generate the chart above are identical to those for the first one, except for different data, of course, so I won't explain them again. Both charts focus on the third quintile, and both eliminate data from 1987 because the rates were so different from the adjacent years, and only lasted for one year.

The point of the chart above is fairly obvious.

Republicans would like us to reduce the corporate tax rates, and some Democrats are thinking about it as well.

But look at the chart above, and ask yourself which way you would jump.

As I've pointed out before, in many places, anyone who has been in business knows that the higher your marginal tax rate is the more incentive you have to plow the money back into the business, where it will be deductible.

That means hiring more employees, buying more equipment, modernizing facilities, and even raising pay more easily—all things which contribute to the economy as a whole.

It also acts as a disincentive to corporate mergers, limiting the negative effects of monopoly without the need of anti-trust actions, and encouraging greater competition.

The above chart is based on the third quintile, as a way of focusing on the middle class, but the basic pattern is the same across the board:

Notice that everyone suffers under low corporate taxes, but the poor suffer the most.

Any intelligent person, wanting to base our next move on previous experience, would think that lowering corporate tax rates is the worst thing we could do.

Any compassionate person, wanting to do everything they can to help the poorest among us work their way into a better life, would be looking at top corporate rates at 48% or above.

They were at 52% for most of the fifties, and we did very well.

They were only around 12-14% just before the Great Depression, and we all know how that saved the economy.

Is there a limit to how high corporate taxes can go and still pay off for everybody?

Probably.

But let's start by finding out where it is, instead of simply running in the other direction—sacrificing the welfare of the entire country on the altar of ideology.

At least that's what I think today.