I'M PUTTING THESE THREE propositions together because they all involve taxes, but in different ways.

Proposition 21 would simply add an $18 annual surcharge to vehicle licenses to provide revenue which would be put in a State Parks and Wildlife Conservation Trust Fund, and designated for the purpose of maintaining and improving our state parks.

It should raise over $500 million annually for this purpose, and would free up about $130 million which now comes out of the state budget for the general fund, thus helping our state budget problems.

The tax is mildly regressive, and that's a point against it, but most people who can afford a car can also afford a mere $18 per year.

On the plus side:

- The park system is the common property of all Californians, and a valuable asset, particularly for those who can't jump on a jet and travel the world to get in touch with nature.

It benefits the average citizen, in this way, even more than it benefits the super-wealthy. - Currently the park system is in bad shape.

It needs maintenance, and has been limping along for some time without enough funds. - The proposition also gives vehicles with California licenses free access and parking in the state parks, which will encourage the very people who couldn't previously afford to use their own parks to do so now.

- Better parks mean more tourism, which is good for the economy.

- This is one way that the average citizen can do something concrete to get around the bizarre, wealth-focused limits on taxation that currently strangle California.

That extra $130 million can be put to good use, and will probably reduce the number of social service cuts in the future, keep some people who are delivering those services on the payroll, and so help California extract itself from the effects of the recession.

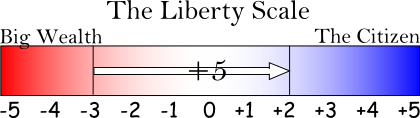

I give the current disrepair and under funding of the parks, and the fees for entrance a -3 on The Liberty Scale.

I give the improvement of our parks and their affordability, and the move by average citizens to free up money for needed services a +2 (allowing for the mildly regressive nature of the fee).

That means Proposition 21 makes an overall difference of +5 on The Liberty Scale.

Vote yes.

Proposition 24 would repeal some recent tax changes which were designed to benefit businesses to the tune of $1.3 Billion per year—most of that benefit going to large corporations, and in many cases out-of-state corporations.

That's money that comes out of education and the general fund (because much of it is earmarked for education already), at a time when our government is struggling, and goes into the pockets of wealthy corporations and individuals.

It's money that otherwise would go for government services that we all need and use in a time when the state is in dire economic need.

There are two points that are crucial to understand while considering this measure:

- The first point, which I've already touched on under Prop. 21, is that money in the state budget provides a triple benefit for Californians:

- It provides valuable services for all of us—well-maintained parks, in the case of Prop. 21, and, in the case of Prop. 24, education for our children, and educated populace for our businesses, and other services from the general fund.

- It does the above by hiring people to provide those services—that is, by creating jobs.

In a time when unemployment is a serious problem, the creation of jobs is a direct and immediate way of addressing that problem. - Those jobs, in turn, create consumers—people who have earned money which they then spend, helping small business to grow and create more jobs, paying taxes, which eases our budget problems more, and in general helping to turn the economy around.

So it isn't a question of jobs and small business vs. government services.

Government services, by their nature, add jobs and help small business.

- The second point is a common misconception—that cutting taxes on businesses creates jobs.

Actually, the exact opposite is true:- A business hires people when hiring those people will benefit the business.

If its profits grow (because of a tax cut) it doesn't automatically hire new employees, unless it thinks those employees will increase its profits, or its market share, or provide some other benefit.

On the other hand a business will hire new employees anyway if it does think it will benefit, no matter what level of tax it is paying. - There is an exception to #1 above: If the tax rate is high enough, it becomes cheaper for a company to hire.

This is because the money, if merely kept, becomes profit—so that the company has to pay those taxes on it, and only gets to keep what's left.

But if that same money is invested in an employee, all of it can be profitably spent there.

Example:- Company A has a marginal tax rate of 0% (I'm exaggerating here to make the point clear).

Company B has a marginal tax rate of 90% (Another exaggeration). - Both companies might be able increase their market share significantly by hiring an employee for $50,000, but times are uncertain, and the gamble might not pay off.

- The gamble will cost company A $50,000 of what otherwise would be pure profit.

But the same gamble will only cost company B $5,000!

Why? Because if company B keeps the $50,000 as profit, it pays 90%, or $45,000, in taxes.

But if company B invests that money in an employee, it can give the employee the whole $50,000, for the price of the $5,000 it was going to get to keep.

In essence, company B gets an automatic government subsidy for hiring employees. - Everything I've said above applies equally to employee salaries.

Employers at a higher marginal tax rate have a greater incentive to give employees raises if they think it will help the business, because it will cost them less, after taxes, than it would if the tax rate were lower.

- Company A has a marginal tax rate of 0% (I'm exaggerating here to make the point clear).

- So taxes on corporations actually encourage them to invest in jobs, while tax cuts do the exact opposite.

- A business hires people when hiring those people will benefit the business.

Next Time, what this means

for Prop. 24, and the

lowdown on Prop. 26...