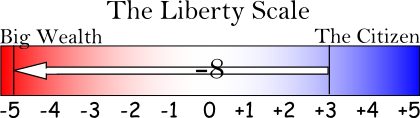

WE'VE BEEN LOOKING at the three tax-related Propositions on the upcoming California ballot: 21, 24, and 26, in light of The Liberty Scale.

In the previous post, I gave Prop. 21 a rating of +5, and outlined two important points about Proposition 24:

- Money spent on government services provides not only the services, but jobs and benefits for small businesses as well, and

- money spent on tax breaks for businesses (unless very carefully targeted) ends up discouraging job creation where the tax itself would have created jobs.

As regards Proposition 24, this means that the current tax benefits to corporations will

- Cut state services, and the jobs and benefits to small businesses they create, while simultaneously

- Discouraging companies from hiring.

And since that means a major loss of money and power for average citizens at the cost of major profits for the already wealthy, I give the current situation a -5 on The Liberty Scale.

Proposition 24, on the other hand, will repeal those tax loopholes, thus

- Providing funds for state services, the jobs that will be created to perform those services, the increased spending by those consumers, and the benefits to small businesses it will create, and

- Providing businesses with a greater incentive to hire and create even more jobs.

Since that means a major gain in work, money, and power for average citizens and small business, at the cost of removing a bit of free profit and extra power from the already wealthy, I give the results of Prop. 24 a +5 on The Liberty Scale.

Which means an overall rating of +10.

A definite yes vote, if you're concerned with liberty.

Proposition 26 also deals with tax-related issues.

It would do two things:

- It would change the legal definition of "tax" in California.

This would mean that many fees and charges—especially those that are aimed at making corporations pay for the damage they do to our communities, or for changes that help them make profits—would now be considered "taxes" and therefore would be much harder—which is to say, virtually impossible—to pass.

Example: the fees charged to a development corporation for the new roads and infrastructure that must be built because of a new housing development.

Example: the cleanup fees charged to an oil company after an oil spill off our coast.

These fees would now be classified as taxes, and because our laws make tax increases almost impossible, the money for these things would have to come out of your taxes instead. - It would make it even harder for the government to manage taxes in general.

Right now the government has to get a 2/3 majority in order to raise taxes in California.

The 2/3 rule is itself an unreasonable burden, because it effectively keeps our elected representatives, the people you and I vote into office, from doing their job where taxes are concerned—raising and lowering them as the health of the state dictates.

The one saving factor in this situation is that under the current law, the legislature can adjust tax rates as needed if the adjustment doesn't lower or raise them as a whole.

So, if the legislature decides a tax is unfair, or has an adverse effect on the economy, it can lower that tax while raising taxes elsewhere, so long as the net effect is zero.

Prop. 26 would make that impossible by changing the rules so that if even one taxpayer's rate is increased a 2/3 majority is required.

The effect would be to hamstring our elected representatives even further, so that they cannot do their job.

The current situation, which allows our representative some ability to adjust the tax system as we wish them to, and makes corporations pay their own way, is far better than the alternative.

I give it a +3 on The Liberty Scale.

The situation under Prop. 26 would make the already bad situation much worse for the average citizen, while at the same time protecting large corporations against paying for harm they do and services which help them make more money.

Under Prop. 26 we pick up the tab—probably in reduced services for the same taxes.

I give that situation a -5 on The Liberty Scale.

Which means an overall rating of -8.

Vote no.